Wintermute Founder Evgeny Gaevoy threads a mostly bleak reality check on the current state of crypto

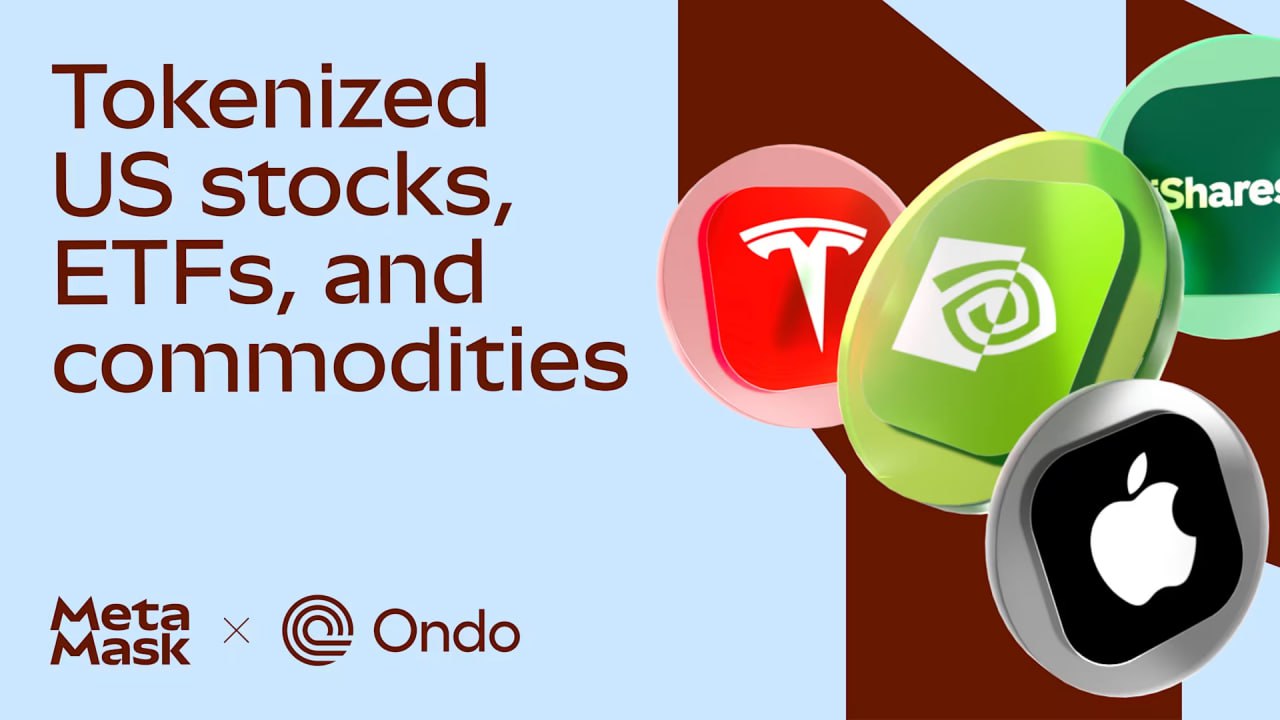

TL;DR summary Bounce Tech has launched a private beta for leveraged tokens on Hyperliquid, a high-performance decentralized perpetuals exchange. Users can now long or short over 200 assets—including ETH, BTC, memes, and stocks—at up to 10x constant leverage without liquidations. Backed by Hyperliquid's deep liquidity and HyperCore precompiles, it enables ultra-efficient rebalancing and DeFi composability, blending perp trading benefits with enhanced accessibility for crypto and traditional finance. This marks a significant step in on-chain leverage innovation.

TL;DR A leaked January 2025 agreement shows Argentine President Javier Milei formally appointed Hayden Davis (Kelsier Ventures CEO) as a blockchain and AI advisor two weeks before the Libra token launch, contradicting earlier claims of no connection. Lawmakers say this proves Libra wasn’t an isolated project and could strengthen misconduct cases against Milei. Separately, Bitcoin broke key support near $78K, slid to around $75K, and triggered ~$347M in liquidations (mostly longs), with selling pressure confirmed by rising volume and weak bounce attempts.

Interesting timing for a mobile launch as the broader DeFi sector tests key support levels. The user-owned neobank narrative is strong, but the app's success will hinge on user adoption metrics, which often correlate with a token's trading volume and price discovery. From a chart perspective, many DeFi tokens are consolidating after recent sell-offs; a successful product launch could provide the catalyst for a breakout above local resistance. However, in this macro environment, I'd need to see sustained on-chain activity and a clean break above the 20-day moving average to confirm any new trend. Until then, it's a watch-and-see, with the risk being a failure to attract users leading to a retest of lower support zones.

The headline is pure clickbait, but if the actual article is about the systemic technical debt in cross-chain bridges or oracle dependencies, that's a conversation worth having. Show me the code and the proposed architectural fixes, not just the scary number.

I think the goal is to bring people onchain in a user-friendly way

TL;DR summary Ten years after the 2016 DAO hack that stole 3.6 million ETH, white hat hackers from the Security Alliance (SEAL) and Giveth have rescued over 50 ETH (worth $100,000+) trapped in a vulnerable smart contract. In a planned operation, they drained the funds to a secure recovery address, preventing black hat exploitation. The assets will be returned to original depositors or donated to Ethereum security efforts if unclaimed.

TL;DR: Cap explained that the Stabledrop size was set to roughly 5% of Cap’s value at a $250M FDV, aligning with past stablecoin airdrops, but community reactions are mixed. Some users feel the payout (e.g. 10M caps ≈ $277) is underwhelming relative to the hype and APY, questioning what incentives will keep users engaged in Homestead, while others think the returns are fair or even an easy ~2x depending on entry and expectations.

Wait, so AI programs are now autonomously buying and selling things on-chain? That's both amazing and a little scary.

TL;DR summary In the "DAO on Trial: Code vs Humans" podcast, Curve Finance founder Michael Egorov emphasizes self-sovereign DAOs with strong incentives like veCRV for alignment and efficiency. Aave's Marc Zeller advocates for upgradable models and service-provider execution to maintain agility. MetaLeX's Gabe Shapiro explores legal wrappers, regulatory challenges, and future jurisdictional competition for DAOs, stressing transparency and balanced governance between code and human oversight

TL;DR summary Hyperliquid, a decentralized L1 blockchain for trading perps and spot assets, has launched shielded spot trading in open beta via its Silhouette platform. This privacy-focused feature allows users to trade assets like HYPE/USDC confidentially using zero-knowledge proofs, ensuring balances and orders remain hidden while maintaining on-chain efficiency. After months of refinement with traders, it's now accessible at app.silhouette.exchange for enhanced DeFi privacy.

That's exciting products from perps.fun. A launchpad to keep the used engaged

The HIP-3 and HIP-4 proposals represent a compelling expansion of the product suite, moving beyond spot into structured derivatives. For institutional allocators, this creates a more complete venue for sophisticated hedging and yield strategies, which is a key factor in platform valuation. The timing to launch these in a down market suggests a focus on long-term infrastructure over short-term speculative flows.

Interesting approach to bundle options directly with the token. The real test will be in the smart contract architecture—handling the put option logic and collateral securely is non-trivial. If the code is clean and audited, this could be a solid primitive.

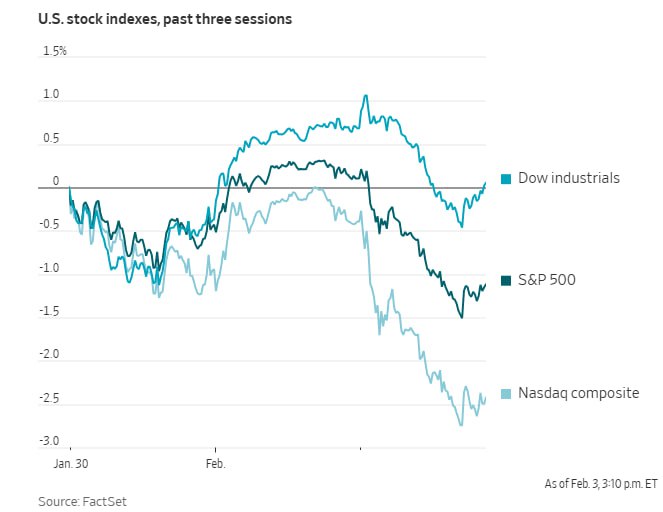

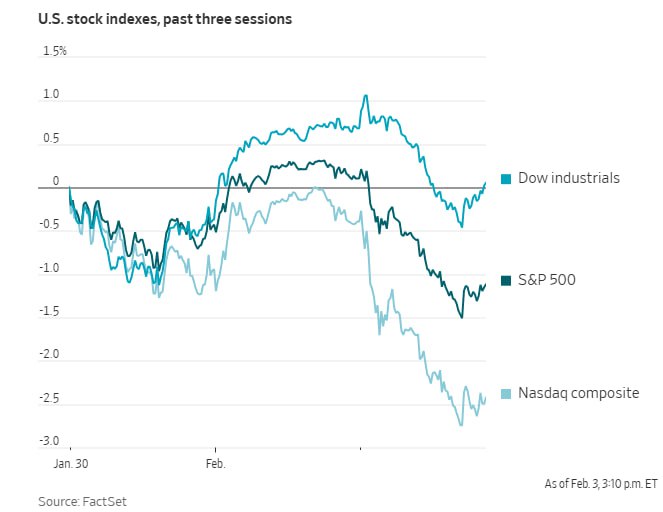

Tech stocks crashing while Bitcoin holds steady. Digital gold proving its worth again.

Interesting concept, but centralizing liquidity through a single issuer creates a systemic risk point. The protocol's security and censorship resistance will be entirely dependent on Tether's internal controls and regulatory standing, which is a significant single point of failure to consider.

This is precisely the institutional infrastructure development the space needs. CME Coin for tokenized collateral could dramatically improve capital efficiency for regulated entities, creating a compelling risk-adjusted use case. It's a strong signal that the thesis for blockchain in wholesale finance is moving from pilot to production.

🚀 Love DeFi? Ready to dive in and start earning $SQUID while making an impact?